And this is why Barack Obama was re-elected in 2012, and why Hillary Clinton will most likely be selected in 2016.

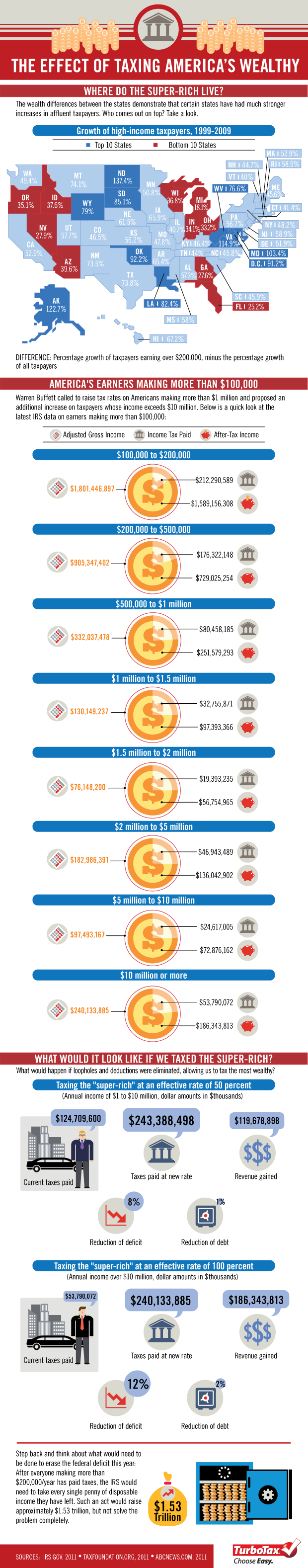

Some of the most socialistic states, such as Oregon, Wisconsin and Michigan were among the bottom states (although, we must add, other such states as Minnesota, Massachusetts, Vermont and others were in the middle of the pack), and most of the freedom-loving states were among the highest in growth, according to “The Effect of Taxing America’s Wealthy” infographic.

Yet, the infographic has an agenda of pro-tax. It “justifies” this by showing that taxes can reduce the deficit by 8-12%. However, anybody who is attuned to reality and who has an ounce of information in his or head knows that income does not and cannot reduce the deficit. Income is what caused the deficit. For every $1 that the government takes in, it spends at least $1.50. That is why there is the deficit. The only solution is to spend less. This is what every individual and family knows; why doesn’t the government and the graphics writer know this?

Moreover, it will cause poverty. It is the wealthy who are able to hire people. A person who earns $10 per hour cannot possibly hire you for $15 per hour. If the wealthy are taxed, then that takes away the money that could have been used to hire someone at $15 per hour. Of course, when the wealthy are taxed, the money can go toward the hiring, maintenance of government bureaucrats. But we have to ask you: Who needs the money more, you or the government?

Likes: We appreciated the map and found it informative.

Dislikes: The “America’s earners” section which was not adequately explained.

The wealth difference between states demonstrates that certain states had much stronger increases in affluent taxpayers. Warren Buffett recently called to raise tax rates on taxpayers making more than $1 million and proposed an additional increase on taxpayers whose income exceeds $10 million. Where do the “super-rich live and what would it look like if they were given additional taxes?” Take a look.