Financial jargon can often puzzle the average person. I own a credit card, but all I really care about is paying my bill on time at the end of the month. It is essential for people to understand what exactly financial institutions offering upon transacting with them. This is mostly difficult to achieve, as deciphering the T&C’s intricately is hard for everyone. One such case is APR calculation, or annual percentage rate that an individual pays on his credit card. We review Bank of America’s infographic as they bid to help customers achieve clarity on the nuances of APR.

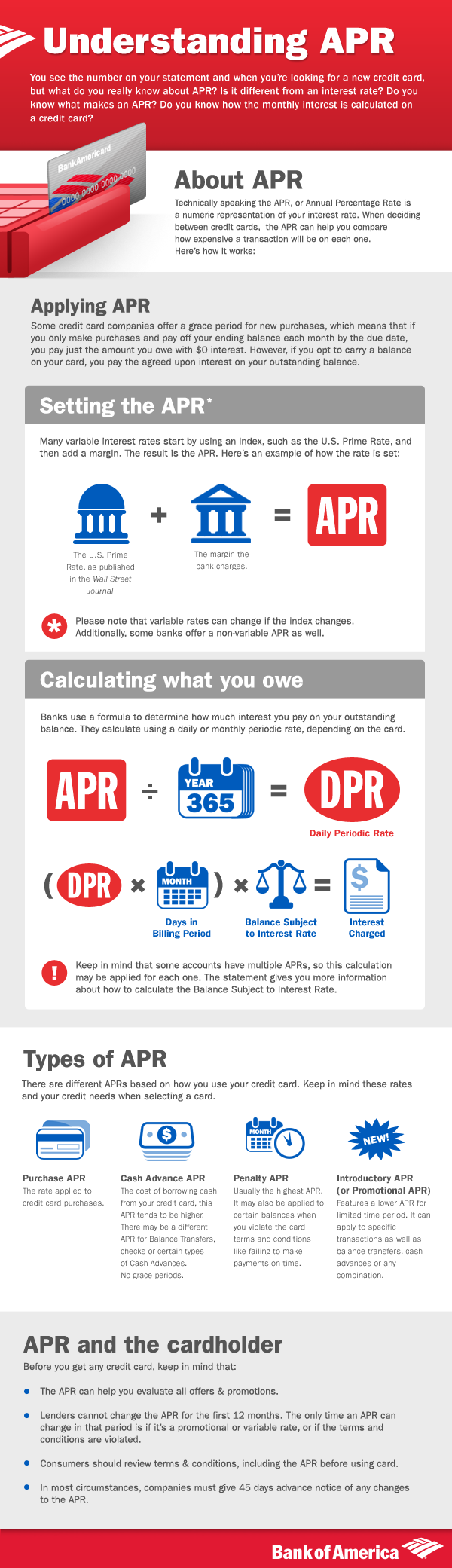

APR helps credit card holders decide on which credit cards they should pick. It tells the holder how expensive a transaction will be on one credit card vs the other. It is basically a “numeric representation of your interest rate”. Having explained the fundamental definition of APR, the infographic goes on to showcase how APR’s are set and how formulae that calculate what you owe are worked out. Both parts are impressively sectioned out, with visual cues that make it easily comprehensible. The layout is clean and makes a complex concept very simple to read.

Then we see what types of APR exist in the market – Purchase APR, Cash Advance APR, Penalty APR and Introductory APR (or Promotional APR). These different APR’s and their knowledge is essential to keep in mind based on the rates they offer and ones credit needs. Like the rest of the infographic, this section is extremely user focused. The tone of the language is personalized, which is definitely appreciated by the reader. Again, the visual cues for each of the types of APR are eye catching but at the same time not over the top.

The infographic ends with APR and the cardholder section – a 4 point do’s and donts on what the card holder should be aware of before getting a credit card. These are – evaluate all offers and promotions, changeability of APR in the first 12 months, reviewing T&C’s before usage and 45 days advance notice before any changes to the APR. This is the most important piece in the infographic, akin to a conclusion section in a business report. Bank of America has simplified a lot of things regarding APR for the average consumer. Many such firms should take the lead as well and assume responsibility towards their consumers to ensure transparency and learning.