For most motorcycle owners, their bike is an extension of themselves. You probably take care of your bike the same way you used to take care of your favourite toy when you were a kid.

It can be quite problematic getting involved in an accident on the road, not just in terms of the damage caused to your bike, but also in terms of the damage it wreaks on your finances. If you end up hitting someone else’s vehicle, you’ll have to pay for their damages and also for your own, which could prove to be quite costly without a two wheeler insurance policy.

There are multiple benefits of opting for an insurance policy. Applying for insurance online is a hassle-free experience as you can avail of cashless facilities and receive 24/7 support for all your insurance enquiries. Also, it’s an instant payout, which is fast and reliable when compared to buying a policy offline, which includes a ton of paperwork and lot of time from your side. This Two Wheeler and Bike Insurance Policy is one such well-designed insurance plan you can opt for, especially if you’re looking for one.

Know Your Coverages

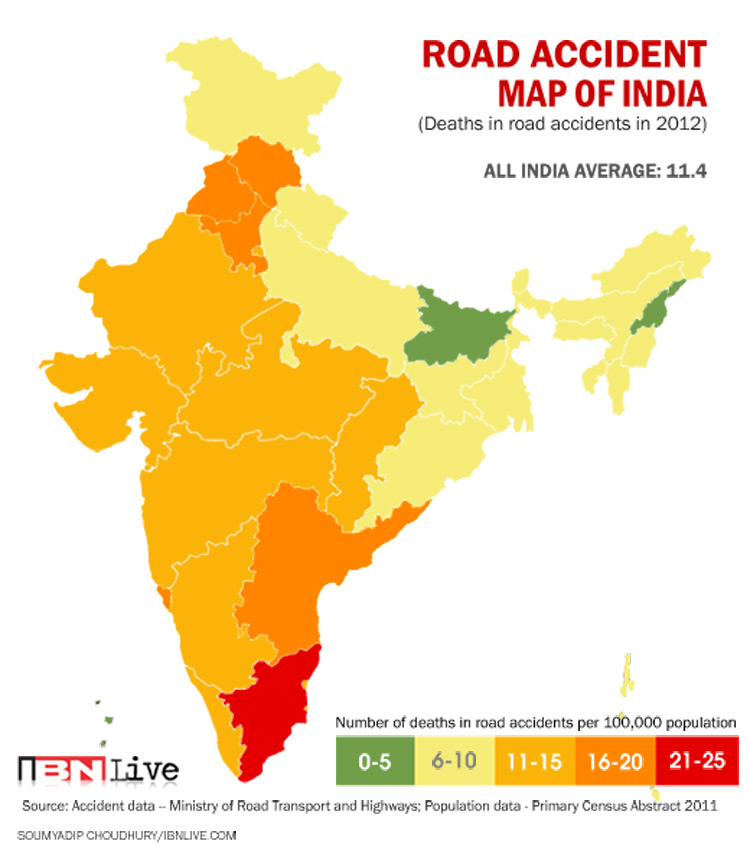

Before you jump right into buying a policy for your two wheeler, make a couple of mental checklists to help you choose a policy that suits your needs. Consider the make and age of the vehicle, cost of fuel, mileage, the tenure of the insurance policy and whether you live near accident prone areas.

There are also various covers that fall under two wheeler insurance policies, such as the third party insurance cover and the personal accident insurance cover.

Reviewing your coverages is very important since it includes various clauses under which you can claim insurance. Some insurance companies offer services like towing facilities or even provide you with a temporary replacement for your vehicle until it is repaired. Check if the insurance company pays for your medical bills in the event of an accident. These things are worth taking a look at before opting for a motorcycle insurance policy.

Don’t forget to take into consideration the tenure of your motor vehicle insurance policy as well – If you’re planning to buy a long term two-wheeler insurance policy, you should search for a 3-year bike insurance or a 3-year motorcycle insurance policy. Lower premiums generally follow if the tenures are longer and vice versa.

Check the Insured Declared Value (IDV) of your bike before you opt for your policy. It usually denotes the market price and depreciation costs, highlighting the net amount the insurance company would be willing to pay in the event of an accident.

Make sure you go in for comprehensive coverages and not the minimal ones if you want protection against theft, natural phenomenons, and armed robberies.

The positive thing about this is that you get a no claim bonus on most two wheeler insurance policies and you get rider incentives annually if you don’t file any claims throughout the span of your tenure. If you’ve got an existing bike insurance policy that is about to expire, then you can renew that as well without paying any extra charges.

Things Your Bike Insurance Does Not Cover

If you use your bike to race, your insurer won’t be financially liable for any of the resulting damages. If there is likely to be more than one rider for your two wheeler, make sure you include that in your application. If you commute with passengers on your bike, you will need to take a supplemental pillion cover. Make sure your documentation and paperwork is in place before you apply for a policy.

Saving yourself the trouble of having to arrange for funds if you get into an accident sounds like a good plan if you own a two-wheeler. Explore all the options in the market and compare them carefully before you buy a two-wheeler insurance policy.