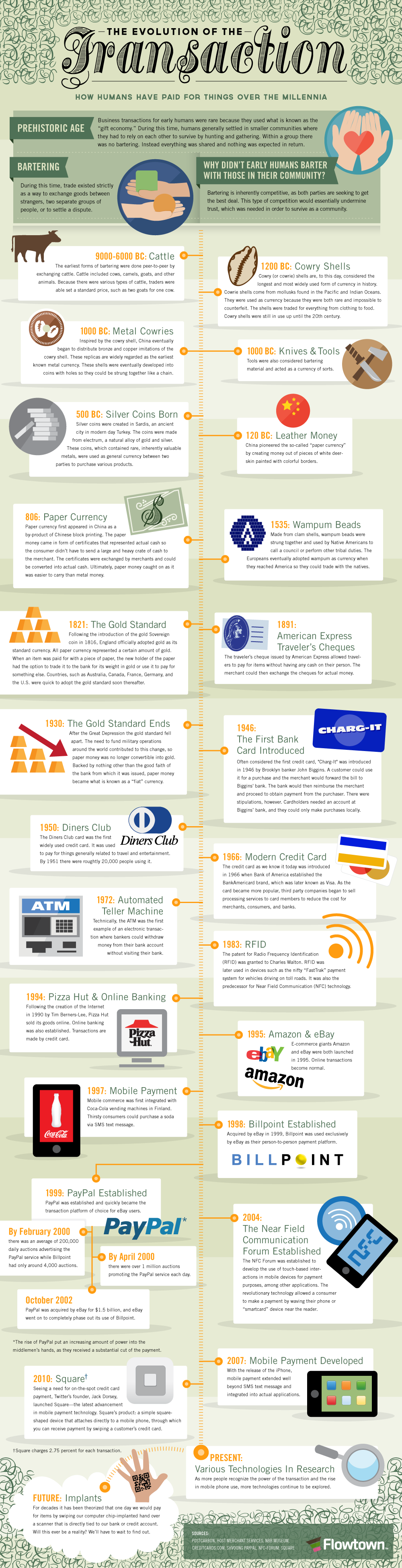

We like money. Who doesn’t? Thus, “The Evolution of the Transaction” grabbed our attention.

It provides some revealing and welcome information. For example, we had thought that the credit card originated in the mid-1960s by several California banks. However, it appears that the very first such card originated in 1946 in Brooklyn. Cursory research from Google and Wikipedia indicates that the bank was Flatbush National Bank of Brooklyn, which merged with (or was bought out by) Manufacturers Hanover at virtually the same time.

As in every printed item, this infographic is noteworthy for what it decides to edit out. There is no mention of the year 1913 in which the Federal Reserve was created. This resulted in the private printing of currency, at interest, which has resulted in massive inflation throughout the years, and the debt devolving onto those who are yet unborn. This, as people are now aware, limits people’s choices in transactions.

For further back in history is the Introduction in which it is asked why early humans did not barter within their communities. The answer is that “Bartering is inherently competitive as both parties are seeking to get the best deal”. ????????? What are transactions? If I am willing to buy a pen for $1 and you are willing to sell a pen for $1 then both of us get what we want. If I want to buy it for $0.90 then you may be unwilling because it will harm your profit margins. If I want to buy it for $1.10 then you are certainly happier, but I am still happy as long as I do not feel cheated. Money itself, like objects (such as cattle), is a form of barter.

Likes: The forms of transactions for the present and for the future are a pleasant addition.

Dislikes: Beautiful organized infographic, nothing to dislike.

Courtesy: Flowtown.com