DBS Bank, the market leader in consumer banking launches Digibank, the future of Mobile Banking in India.

Digibank is a complete bank in a mobile phone which is completely electronic and paperless.

The good part is that it does not require physical branches. DSB Bank is Leveraging on India’s takeup of mobile phones and the growth in social media and e-commerce in the past 18 months.

|

|

Digibank is aiming at Indian consumers who are ready to embrace digital banking. With success, digibank will be replicated in Indonesia and China as well as a leading thrust in DBS’ overseas expansion plans. As part of DBS’s multi-billion dollar investment in digital technology, digibank is taking creative ideas and Fintech into the marketplace and individual lives.

Utilising innovation models developed internally and externally along with agile human-centred design processes, digibank is integral to customer lifestyles.

Digibank’s unique value & sales proposition (USP) includes the following:

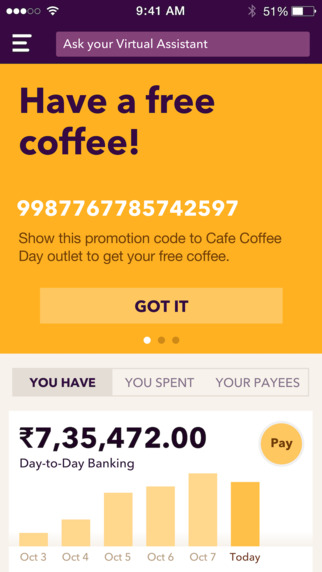

- Intuitive full service banking on a mobile when and where it is needed

- Easy to start and execute within 90 seconds without going to a branch

- Interactive engagement with Virtual Assistant™ & 24×7 guidance

- Faster time to market for new service and product opportunities

- Lower cost to execute and maintain as compared to other options

- Efficient: seamless and uninterrupted execution through the use of technology and process innovation (traditional operations not required)

- Flexible: clients can use their mobile app profiles to tailor experience

- Safe & Secure: security designed within the mobile (including soft-tokens) with timely updates in response to evolving threats and requirements

- Robust: easily and seamlessly integrated across multiple devices

This post has been presented by DBS, but all thoughts and opinions are my own.”