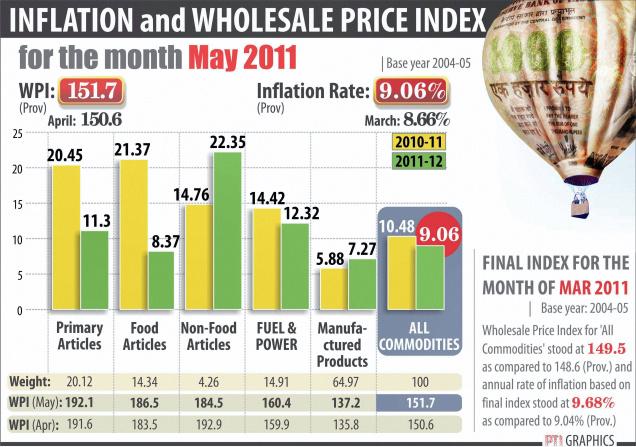

We have heard it said that “inflation is too many dollars chasing after too few goods”; and several sources corroborate that. The “Inflation for the Month of May 2011” infographic shows the statistical results of that.

Inflation can be too high. Many things have doubled (more or less) in cost in the past five or so years. We may not care or pay attention to it much because of the somewhat gradual nature of it (fortunately, there has been no hyperinflation).

In addition, we may not purchase the same thing frequently. For example, a good roll-on deodorant could last several months of use, even if we use it almost every day. Thus, we are not aware of it until many months later when we have to purchase the item again. Even then, it can still be economical on a long-term basis. In addition, very cheap things can still be cheap. If you are buying a small bag of peanuts then it was very cheap. Even after doubling in price, it is still just a few pennies. Nevertheless, it can adversely affect you unless your salary has also doubled in value.

Inflation can be too low (or maybe not). Many people seem to believe (or to parrot the belief) that deflation is bad. However, in the United States in the 19th century, there was continual deflation, and people still survived, and even prospered. We can see deflation in the prices of computers, tablets and smartphones, allowing us to be productive in other areas.

Likes: You can extrapolate the monthly result to see what it was theoretically like for the entire year.

Dislikes: There is no attempt to show the impact of inflation, as this portion has attempted to do.

Courtesy: thehindu.com