One cannot deny that two wheelers rule the streets in India no matter which city you go. The convenience offered by two wheelers is irreplaceable by any other means of transport. A bike makes a practical and smart choice whether it is meant for going to college or for your office commute. Though this mode of transport excels in convenience, it is not free from certain risks. An accident on a two wheeler proves to be far more fatal in comparison to a four wheeler. This is why you should secure yourself with a bike insurance from a trusted insurance company.

Why is it a “must” to have bike insurance?

Every year, over 10 million new two wheelers are purchased in India. However, the development in road infrastructure is insufficient to accommodate all the vehicles. With potholes & bumps quite too common on our roads, and the poorly implemented traffic rules, even a skilled driver may have to struggle. If there is any unprecedented mishap such as road accident, damage to third party property, or theft, then a two wheeler insurance would help you cover all the costs. As per law, it is mandatory to own insurance for riding your vehicle on Indian roads. A motor insurance basically offers financial cover for any damage caused to your bike in case of an accident, theft or due to any other reason covered under the policy of your two wheeler insurance.

Types of two-wheeler insurance in India

A third party insurance for bike is the basic policy that the law requires you to have. This policy covers any damage caused to property, bodily injury or death caused to the third party involved in the mishap. Any comprehensive insurance package policy covers damage or loss caused to the two wheeler by man-made or natural causes in addition to third party coverage. It also covers theft and any other cause depending on the policy coverage offered by the insurance company. All comprehensive policies offer this policies offer protection against strikes, vandalism, riots and even natural calamities such as storms and floods.

How is the premium calculated?

The features of your vehicle play a pivotal role when it comes to calculating your two wheeler insurance premium. The basic coverage opted for, the city of purchase, cubic capacity of the vehicle and the cover opted for accessories determine the premium. Select insures offer add-on covers and you need to pay extra premium over these.

Two wheeler insurance renewal

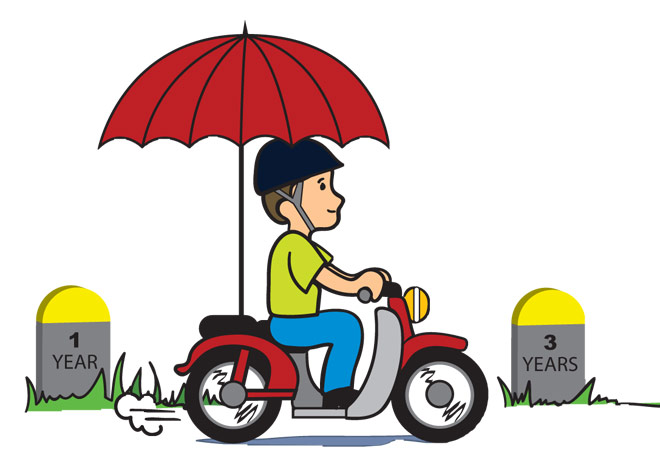

It is important for you to renew your insurance before the due date in order to maintain continuity. Most of the companies offer a basic one-year insurance policy. There are select insurers who also offer long-term insurance for two wheelers. If your policy has lapsed, then you will have to get your vehicle inspected for renewing the insurance. If you haven’t made any claim in a year, then no-claim bonus is offered to the policy holder. This has been introduced to reward policy holders for safe driving.

What happens if you sell your bike?

If you sell your bike, then you can easily transfer your two-wheeler insurance as well. The insurer will have to be notified within fourteen days by the new owner of the vehicle after purchase. All relevant information pertaining to the transfer of insurance will have to be furnished during the process.

How to file a claim?

In case of any mishap, you will have to contact the insurance company immediately through phone or mail for initiating the claims process. You will have to submit the claims forms along with all necessary documents such as FIR, driving license and estimate of repairs. Once the damage has been accessed by the surveyor, you would be offered compensation by the insurance company. First-time buyers should always look for a reliable insurance company and select the right policy type. It is vital to purchase bike insurance and it is also equally important to keep renewing the policy as long as you are using the bike. Make sure to rely on an insurance company that gives utmost priority to its clients.