How can I become richer? Though many of us think about this… how many of us have actually done something substantial about it? If we were to answer truthfully most of our answers would not be in the affirmative. You wish to be able to pay all our monthly bills and yet have more than enough left to plan a nice holiday with your kids, or simply just spend lavishly without needing to use the credit card. But with expenses mounting everyday this may seem a far away dream at times. Becoming richer does not necessarily have to remain just a dream and we can actually choose to multiply our savings for a richer future; by simply changing some of our habits and attitudes today.

The simple truth to finding success is that it is a process that takes place over many years and wealthy people do not just suddenly become rich and successful. Long before most wealthy people got rich (unless they inherited the money); they made it a habit of living below their means and saving enough first.

Here are 5 habits which could possibility be stopping you from getting rich.

- Not making a financial plan

Most of us say we have a financial plan but rarely do we do much to get it executed. In fact we can at times be our own worst enemy when it comes to getting financial success. Most of us have a long financial to-do-list but it remains in our mind and never really gets put on paper; hence never gets completed. For instance things like – starting a new investment, closing a dormant bank account and so on. But by making these small changes; though we do not realize now; we can actually make a much bigger difference to our net worth in the long term. As we wait from one weekend to another this list keeps growing and we keep missing out on future opportunities as each day goes by.

Solution – the best way is by becoming a little more proactive and enthusiastic about your financial planning, by actually putting the plan on paper. Then next you can show this plan to your trusted close friends and family so that everyone is aware of your financial plan. Once you are done you can allot a specific time for financial tasks; and since you have shown your goals to someone else; they would keep asking you if you have made the particular investment, or other tasks on your financial to-do list; which would push you into getting at least something done on your list.

- Letting your money sit in the bank account/FD

You may already be saving 30% or more of your monthly income, but are still not on the path towards future wealth; if you are leaving it to sit idle in your savings account. Fruits and vegetables were much cheaper 10 years back; and will be more expensive than now in the future. Due to inflation, just letting your money sit in your locker or savings account can actually work against you as it leaves a false sense of security about the future. You are actually losing money to inflation and also decreasing your future net worth. Besides this if your income is above taxable levels; by just letting the money sit idle and not investing in tax saving schemes also means that you will be paying that amount to the government as taxes; rather than putting it in a fund which would have multiplied later on. Another mistake most of us make is that we invest once and feel that we have done our bit, but this too is not enough to actually increase our network in the future.

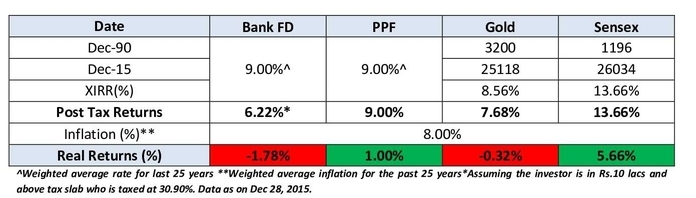

Solution – make your money work for you; as a rupee today is worth more than a rupee next year. Instead of letting your money sit idle, look for opportunities where it will grow or multiply. You can use it in expanding your business or investing in an additional business. If you find this too risky; there are various financial instruments in the market which offer a balance between debt and equity which you can consider investing into. Also instead of putting lots of money in FDs, use it to invest in equity funds such as ULIPS and mutual funds which can also be taken online; especially as they have been known to give the most favorable returns in the long term. For instance as seen in the table below after countering inflation also it can be seen that Sensex i.e. Equity has managed to generate highest positive real returns of 5.66% whereas Bank FDs have the lowest returns of -1.78%, i.e. negative real returns.

- Not investing in equity

There are 2 reasons why people do not invest in equity; the first it is that they consider it to be too risky; and feel it safer to out their money into fixed deposits it being a safe option for guaranteed returns; which is also easy to do. Also since out parents have been doing it all along we follow suit; but in today’s world to get rich we have to consider taking some calculated risks as well. Another reason we do not invest in equity is because most of us do not understand the stocks and find it difficult to time the market as to when we need to invest.

But unfortunately this could be a habit stopping you from not only increasing your net worth; but possibly heading for quite a difficult future retirement. While staying away from very risky assets is not a wrong decision; there are some calculated risks which are essential to take if you want to get richer and can take much more easily earlier on in life rather than later on when you would need to think twice before taking such risks.

Solution – Most rich people are known not to put all their money in just one or even two asset classes; and prefer spreading their savings across a variety of investments by diversifying their portfolio. So while continuing keeping a percentage of your investment in FD’s; for your portfolio consider getting some stocks with blue chip companies; starting a PPF, and in addition to this, starting an SIP with an equity based fund or ULIP plan. Real estate, collectibles and startups are also something you can think of at a later stage. This way you get the advantage of multiple sources of growth; and in a way actually also diversify and be able to take a more calculated risk.

- Giving into temptations easily and overspending

Everywhere we look today there is temptation to live beyond our means. Right from the television to friends, family, magazines, colleagues- it is everywhere and has become very difficult to escape. Unfortunately this habit leads to debt accumulation, under-saving and long-term financial insecurity.

Solution – One of the ways to get out of this habit is by trying to avoid malls, retails emails and other obvious avenues which make us spend more and instead get into activities which will motivate us to increase our wealth. There are many books written by wealthy people providing tips on investments which can make you rich, additionally the internet provides an abundance of information on financial instruments that you can invest into. There are also various funds you could consider investing in online in a few easy steps; instead of buying yet another mobile phone or expensive bag online. You might have met someone who lives very modestly and then are surprised to find out that they are actually millionaires. There are a lot of successful people around us who choose to live below their means and rather than showcasing their money prefer investing it well; for a wealthier tomorrow.

- Using inefficient payment methods

The biggest threat to your financial freedom is very easily utilizing inefficient payment methods. For instance for saving tax we only wake up at the end of the financial year and hence end up using the yearly investment pattern rather than the SIP mode of payment. This can result in losing money as if you are taking an equity based fund; a SIP mode of payment can average out the ups and downs of the market; but if you leave it for the end and make a yearly investment; then you might end up buying the fund during a time when the market rates are very high. Other than this as various other responsibilities creep in; we sometimes forget to pay the credit card and other bills on time which can result in extra unnecessary payments and eventually cause money crunch situations over a longer period of time. If you ever want to get rich, you need to instantly ditch this habit of inefficient modes of payment.

Solution – The best way is to be more careful about how you make your investments and only make a lump sum investment if you are sure the market is low and will increase soon. Moreover commit to paying off your bills on time to avoid any extra payments later on and instead use your credit card to maximize rewards, points and discounts. Consider hiring a qualified and experienced financial adviser if necessary, who can give you the right tips on how to get rid of your debts quickly and start investments as fast as possible by setting up a SIP for you; which can even be taken online at as low as Rs. 2000 per month.

In conclusion being impulsive, emotional or naïve about money matters can seriously hinder your chances of becoming rich. In short you need to get rid of your debts by changing your spending habits, and start using those savings towards different types of investments. While changing your lifestyle and habits may seem difficult today; it will pay off tomorrow and your rich future self will thank you for it later on.