With the recent cancellation of bail for Bengal’s ex-transport minister, Madan Mitra, the Supreme Court and the Central Bureau of Investigation continue their efforts to bring to justice the people involved in the fraudulent chit fund that amassed nearly Rs 10 lakh crore over the course of around a decade.

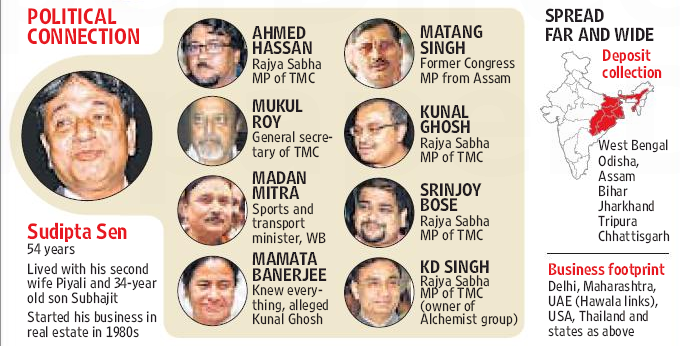

The Key People

The Saradha Group was founded and headed by Sudipto Sen, original name Shankaraditya Sen, who was in his 50s by the time of his arrest. In his youth, he was a member of a violent communist uprising in West Bengal, and reportedly had plastic surgery in the 1990s, prior to his rise in prominence as Sudipto.

Arrested alongside him was Debjani Mukherjee, another executive director in the group who would handle the responsibility of signing cheques. She originally joined as a receptionist in the middle of the group’s stride in 2010, soon before it made the most money in its history – Rs 10.08 billion, according to a graph lifted from a report by the Special Investigation Team handling the case.

The Scheme

The Saradha Group rose to fame in Bengal by promising astronomical returns on investments. Agents were paid up to 40 percent in commission for collection funds from rural communities, quickly creating a massive pyramid scheme. The money collected would then be laundered through a number of bought or newly-founded companies, to avoid the initial scruple of regulatory agencies.

The companies under the Saradha Group issued redeemable preferential bonds and debentures. However, as per the law, a company cannot raise capital from more the 50 individuals without issuing a balance sheet to the Securities and Exchange Board of India.

After negligence following the group’s activities in Bengal, SEBI confronted first them in 2009. Feeling the heat, the group increased the amount of companies holding capital under its name, and then began branching out into every imaginable industry – timeshares, real estate, motorcycle manufacturing, tourism packages, infrastructure finance, food processing and so on. By then, investments were fraudulently sold in the form of a chit fund, which is an Indian collective loan and investment scheme regulated by local state government, rather than SEBI.

SEBI warned state governments of the Saradha Group’s chit fund in 2011, upon which the group acquired the shares of a large number of its companies, sold them, and embezzled the money through several accounts.

Political and Celebrity Stardom

By investing in media and the film industry, the group achieved and maintained high visibility well into 2013, despite several efforts from politicians and the Reserve Bank of India to take down the scheme.

Then, in April 2013, Sudipto Sen admitted to bribery and tried to flee arrest. Bribing of state government officials and political leaders let the group continue on with its fraudulent scam until then, but the imminent collapse was rapid – including at-the-time Transport Minister Madan Mitra, who even encouraged people in West Bengal to invest their savings into the group’s companies, and allegedly acquired bail illegally, as his “influence was all pervasive”, stated a CBI counsel, who also called for a cancellation of the bail because he could “tamper evidence”.

According to Transparency India’s Corruption Perceptions Index, India ranks as highly corrupt, with a score of 38 where 100 is least corrupt, and 0 is most corrupt.

Today, the full damages of the scheme are still nowhere near resolved, and updated Media houses like Dainik Bhaskar will continue with Hindi news coverage as the story evolves.

Sources

http://www.bhaskar.com/

https://commons.wikimedia.org/wiki/File:Saradha_year_on_year_money_collection_graph.png

http://www.transparency.org/research/cpi/overview