The Nifty 50 has been trading under pressure and has been unable to gain traction to the extent that investors are willing to push prices up to fresh all-time highs. This comes as European and U.S. bourses are surging and Nikkei is poised to make all-time highs. The issues appear to be the cash crunch that is affecting India in the wake of the change to new money.

Indian Economy is Under Pressure

India is still feeling the brunt of a 1-2 punch that has plagued the Indian economy over the last year. The first was Modi’s ban last November of 86% of the country’s cash. This was put into place to help generate income for the state as many wealth people are hording cash, and the hidden market was going untaxed. Only 3% of the entire Indian population is taxed, and most citizens are struggling to make ends meet. The second issues that has weighed on the Indian economy is the overhaul of the tax system aimed at turning the country’s 29 states into a single market.

Despite the subdued momentum in the actual Indian economic data points, sentiment continues to rise. The BSE Sensex index, which is up a solid 18% for the year is now forecast to continue to rise another 3% by the end of 2017. Analyst expect the index to increase to 32,500.

The tax reform Modi installed on goods and services Modis was initially hailed as beneficial to the economy as it would simplify the Indian business structure over the long run. Unfortunately, the implementation has generated a major disruption.

In May of 2017, the government banned the sale of cows for slaughter, sending the meat industry into a frenzy. Cows are considered sacred by the country’s Hindu majority. The ban was then suspended by India’s Supreme Court in July. The change in policy created confusion which generated volatility, and substantially reduced exports.

The handling of the Indian economy has become a touchy issue and recently Modi broke his silence on this issue and addressed recent criticisms over his handling of the economy. Mr Modi’s government says the slowdown is transitory and occurring because of immediate disruption of imposing the country’s first national goods and services tax.

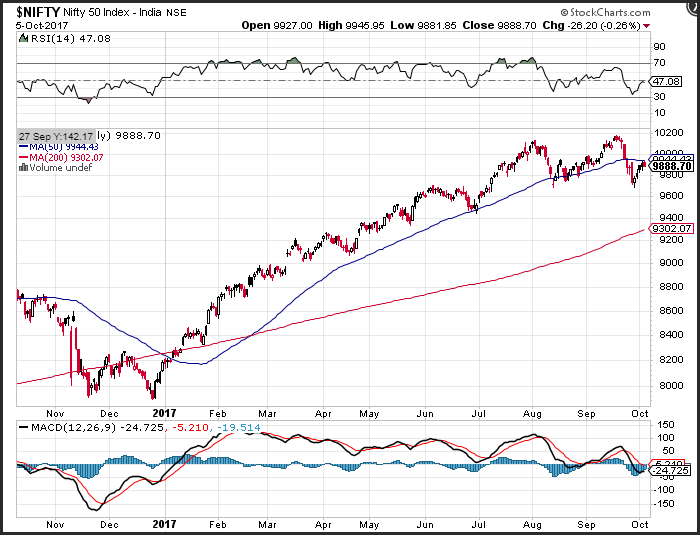

The Nifty is Forming a Topping Pattern

The Nifty 50, which can be transacted using CFD trading, has rebounded after testing support levels which coincided with the August lows near 9,700. A break of this level would likely lead to a test of target support on the Nifty 50 near the 200-day moving average at 9,302. Resistance on the Nifty is seen near the 50-day moving average at 9,944, and then again at the all-time highs near 10,200. Negative momentum on the Nifty is decelerating as the MACD (moving average convergence divergence) index prints in the red, but the MACD histogram, is moving higher with an upward sloping trajectory which points to consolidation for the Indian bourse. The consolidation is confirmed by the relative strength index (RSI) which is a momentum oscillator that measures accelerating and decelerating momentum. The current reading of 47, is in the middle of the neutral range and reflects consolidation.